Weekly Market Insights | December 30th, 2024

Holiday Spending Up

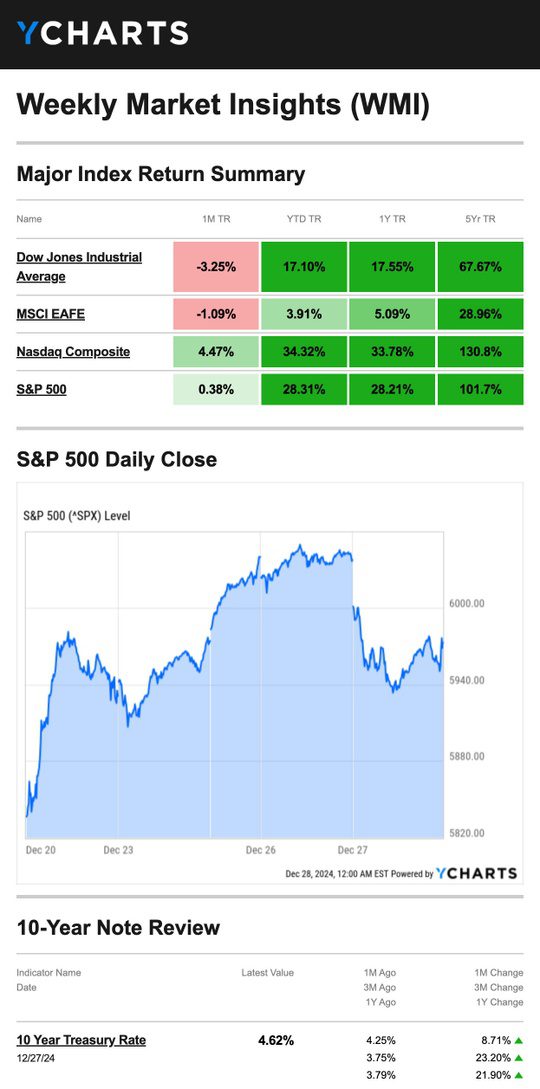

Stocks notched a slight gain over the holiday week. A tech-driven rally in the first half of the week was clawed back in the second half as investors took profits following the market holiday.

The Standard & Poor’s 500 Index advanced 0.67 percent, while the Nasdaq Composite Index rose 0.76 percent. The Dow Jones Industrial Average added 0.35 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 1.54 percent.1,2

Ho-Ho, Then No-Go

Stocks rallied during the first half of a shortened holiday trading week. Holiday cheer won out despite news of declining consumer confidence in December, a drop in durable goods, and new home sales reporting below expectations.3,4

The “Santa rally” lost its ho-ho-go after the midweek holiday. Megacap technology stocks led markets down on Friday, giving back most of the gains from the first half of the week.4,5

Source: YCharts.com, December 28, 2024. Weekly performance is measured from Friday, December 20, to Friday, December 27. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

The Real Santa

While Santa got the headlines, the consumer drove the holiday shopping sleigh this year.

Holiday spending—defined by the period from November 1 through December 24—rose 3.8 percent in 2024, compared with 3.1 percent in 2023. Economists closely follow consumer activity since consumer spending makes up roughly two-thirds of total gross domestic product. Market watchers attributed the strong job market and growth in household wealth as the primary drivers of consumer strength.6

This Week: Key Economic Data

Monday: Pending Home Sales. 3-Month Treasury Bill Auction.

Tuesday: Case-Shiller Home Price Index.

Wednesday: Stock market closed.

Thursday: Jobless Claims. EIA Petroleum Status Report. Fed Balance Sheet. 30-Year Treasury Bond Announcement.

Friday: Motor Vehicle Sales. ISM Manufacturing Index. Federal Reserve Officials Thomas Barkin and Mary Daly speak.

Source: Investors Business Daily – Econoday economic calendar; December 27, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Friday: The Greenbrier Companies, Inc. (GBX)

Source: Zacks, December 27, 2024. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Food for Thought…

“The strongest of all warriors are these two- Time and Patience.”

– Leo Tolstoy

Tax Tip…

Do You Have to Pay Taxes on Your Hobby?

Whether you picked up embroidering, dog grooming, or making jewelry, a side hobby may or may not require paying taxes.

Does your kids’ lemonade stand need to pay taxes? Probably not but if you’re doing something like selling cookies out of your kitchen, you might need to check out the rules.

Here are some things to consider when determining whether your activity is a hobby or business:

- Is your hobby carried out in a businesslike manner?

- Do you maintain complete and accurate books and records for your hobby?

- Is the effort you put into your hobby intended to make a profit?

- Do you depend on the income from your hobby for your livelihood?

- Do you know how to carry out your hobby as a successful business?

- Have you made a profit from your hobby?

If you receive income from your hobby with no intention of making a profit, you may have to report the income to the IRS.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS7

Healthy Living Tip…

How Well Do You Know Your Sunburn Protection Factor?

We all know that protecting your skin from the sun is important, but did you know that not all sunscreens are made equal? Dermatologists have some specific recommendations when it comes to your Sunburn Protection Factor (SPF). Here are some tips:

- Choose a broad-spectrum sunscreen that protects you from both UVB and UVA rays.

- Always use at least SPF 30

- Choose a water-resistant sunscreen.

- Don’t forget your lips! Apply sunscreen to your lips or use a chapstick with SPF 30 or higher.

- Reapply your sunscreen every 2 hours if you’re sweating a lot in the water.

- Apply enough sunscreen to cover all skin that clothing will not cover. Most adults need about 1 ounce—or enough to fill a shot glass—to cover their bodies completely.

- Apply your sunscreen 15 minutes before going outdoors.

These tips will help you choose the best sunscreen to protect your skin for years.

Tip adapted from American Academy of Dermatology8

Weekly Riddle…

Throughout Friday, Hanna asks her mother the same four-word question. On each occasion, her mother gives her a different answer. What is the question?

Last week’s riddle: It softly goes up and down the stairs in many homes and office buildings, yet it never moves. What could it be?

Answer: Carpet.

Photo of The Week…

Delicate Arch

Arches National Park, Utah, USA

Footnotes And Sources

1. The Wall Street Journal, December 27, 2024

2. Investing.com, December 27, 2024

3. MarketWatch.com, December 23, 2024

4. CNBC.com, December 26, 2024

5. The Wall Street Journal, December 27, 2024

6. MarketWatch.com, December 26, 2024

7. IRS.gov, March 18, 2024

8. American Academy of Dermatology, August 1, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2024 FMG Suite.