Weekly Market Insights | January 6th, 2025

Stocks Decline Slightly as New Year Dawns

Stocks edged lower last week despite a powerful end-of-week rally.

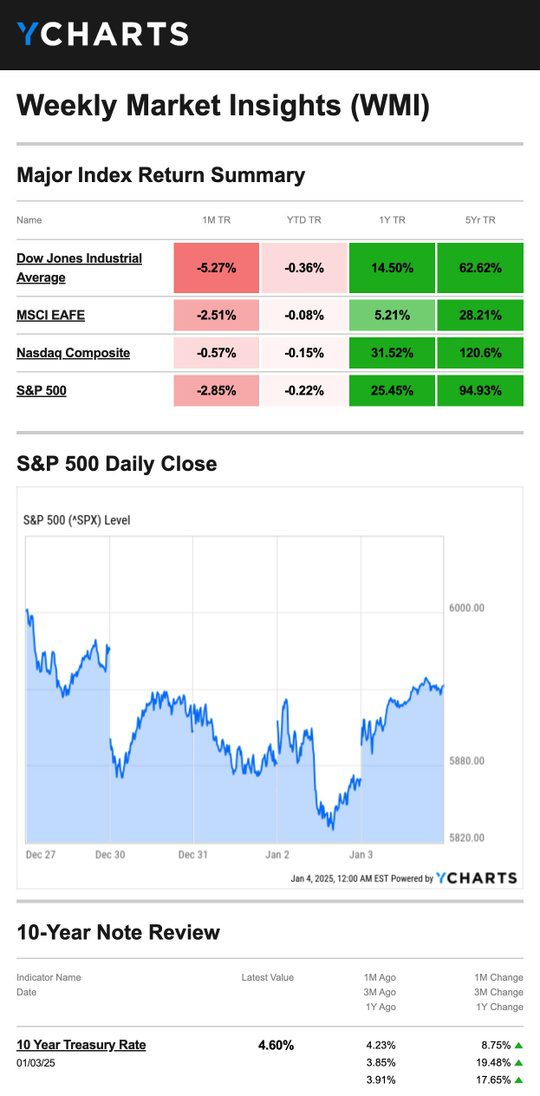

The Standard & Poor’s 500 Index lost 0.48 percent, while the Nasdaq Composite Index slid 0.51 percent. The Dow Jones Industrial Average fell 0.60 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, dropped 0.90 percent.1,2

Selling Then Buying

Stocks were under pressure right out of the gate on Monday for no apparent reason other than worries over the loss of year-end momentum. By the end of trading on Monday, markets recovered some losses, but the selling picked up again on Tuesday.3,4

After being closed for the New Year’s holiday, stocks opened higher for the first trading day of 2025. But sellers gained the upper hand by the end of trading. On Friday, Investors perked up with tech stocks leading a recovery rally that erased most of the week’s losses.5,6

Source: YCharts.com, January 4, 2025. Weekly performance is measured from Friday, December 27, to Friday, January 3. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Megacap’s Mega Influence

Megacap tech stocks have captured many headlines over the last two years as the S&P 500 posted double-digit returns (24 percent for 2023 and 23 percent for 2024).

And for a good reason—megacap tech stocks were doing most of the work. For example, during the past 12 months of trading, more than half (53 percent) of the S&P 500’s return can be attributed to the Magnificent Seven–the seven megacap tech companies that most investors would consider household names.7

This Week: Key Economic Data

Monday: Fed Official Lisa Cook speaks. Factory Orders.

Tuesday: Fed Official Thomas Barkin speaks. International Trade in Goods and Services.

Wednesday: FOMC Minutes released. ADP Employment Report. Fed Official Christopher Waller speaks.

Thursday: Stock market closed for President Carter’s state funeral.

Friday: Employment Situation. Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; January 3, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Jefferies Financial Group Inc. (JEF)

Thursday: Infosys (INFY), Constellation Brands Inc. (STZ)

Friday: Bank of America Corporation (BAC), Wells Fargo & Company (WFC), BlackRock, Inc. (BLK), Delta Air Lines, Inc. (DAL)

Source: Zacks, January 3, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Food for Thought…

“The biggest disease today is not leprosy or tuberculosis, but rather the feeling of being unwanted.”

– Mother Teresa

Tax Tip…

Tips for Good Recordkeeping

When you file your tax return, the first step is to prepare your records. Good recordkeeping throughout the year can make filing your taxes easier.

Here are some recordkeeping tips:

- Identify all sources of income.

- Keep track of expenses.

- Add tax records to your files as you receive them to make filing easier.

- Organize support items that you may need to clarify your tax return.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS8

Healthy Living Tip…

How to Drink More Water Throughout the Day

Drinking enough water is essential to keep you feeling your best. While there aren’t any strict rules on exactly how much water you should drink, you should listen to your body to ensure you’re getting enough.

Here are some tips on how to drink more water throughout the day:

- Keep a reusable water bottle with you, saving plastic and making drinking water more convenient (and fun).

- Set reminders on your phone to drink water, or “anchor” drinking water to other habits throughout your day (for example, drink some water at the end of every meeting).

- Replace other drinks, such as coffee and soda, with water.

- Drink a glass of water before every meal.

- Flavor your water with fruit or healthy water enhancers.

Tip adapted from Healthline9

Weekly Riddle…

David put on a white shirt with three large holes in it and went to the grocery store. No one gave him a funny look; no one objected to it. What kind of shirt was David wearing?

Last week’s riddle: Throughout Friday, Hanna asks her mother the same four-word question. On each occasion, her mother gives her a different answer. What is the question?

Answer: “What time is it?”

Photo of The Week…

Surfing Pulau Panaitan

Jakarta, Banten, Indonesia

Footnotes And Sources

1. The Wall Street Journal, January 3, 2025

2. Investing.com, January 3, 2025

3. CNBC.com, December 30, 2024

4. The Wall Street Journal, December 31, 2024

5. CNBC.com, January 2, 2025

6. CNBC.com, January 3, 2025

7. The Wall Street Journal, December 31, 2024

8. IRS.gov, October 2, 2024

9. Healthline, October 3, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2025 FMG Suite.